Members of the CSF

Who are the members of the CSF?

The CSF is a self-regulatory body that covers multiple disciplines, since its members often work in more than one field or registration category.

The CSF oversees professional development and provides guidance for many professionals, who must use the titles dictated by the laws and regulations of their field of practice.

― Mutual fund representative

This professional may provide advice and recommend that their clients invest in mutual funds appropriate to their situation and investor profile. Mutual funds are pooled investments in which investors (collectively) put their savings with the aim of achieving financial goals such as retirement, buying a property, etc.

― Financial security advisor (or personal insurance representative)

Financial security refers to the field of personal insurance, i.e. life and health. The purpose of insurance is to provide financial protection and mitigate the risks associated with illness or death, as well as help safeguard your standard of living and that of your family, for example. A financial security professional can provide you with advice and products in these fields.

― Group insurance and annuity advisor (or “group insurance representative”)

This professional offers employers products and advice related to insurance and pension plans designed specifically for businesses. Here too, the term “group” refers to the concept of “pooling.”

The advisor analyzes the needs of companies and their employees, in order to offer them products and advice related to group insurance plans and annuity plans provided by one or more insurers.

― Scholarship plan representative

This professional offers clients investments specifically designed to finance their children’s education, i.e. scholarship plan units. These products fall under the category of post-secondary education savings plans.

― Financial planner

This multi-skilled professional may offer advice in seven fields: insurance, finance, taxation, legal matters, investments, retirement, and estate planning. However, if they wish to sell financial products, they must obtain an additional licence for each type of product. To sell life insurance, for example, they must hold a financial security advisor licence. Financial planners provide personalized financial planning that includes each aspect of the fields they have mastered.

Keep in mind that only graduates of the Institute of Financial Planning may hold this professional title. Professional development for financial planners is provided by three bodies: the Institute of Financial Planning, the CSF and the AMF.

How do I know if my advisor is trustworthy?

All professionals must be licenced in order to practice in any of the disciplines and registration categories overseen by the CSF.

More specifically, in order to obtain their licence to practice, representatives must:

- Hold a certificate issued by the Autorité des marchés financiers.

- Pay the annual membership fee to the CSF.

- Be covered by professional liability insurance at all times.

To find out if a professional is authorized to offer the services they are proposing, it is important to check the Register of firms and individuals authorized to practice, maintained by the Autorité des marchés financiers. This register contains the contact information for the professionals who are members of the CSF and indicates the fields in which they are authorized to practice. The process takes only a few seconds and allows you to verify if your advisor is in good standing.

To check if a professional is a member of the CSF, click here.

If your search yields no results, please contact the Information Centre of the CSF.

Professional titles and designations granted by the CSF

Professional titles in life insurance

To help its members holding a licence in personal insurance or group personal insurance gain more in-depth expertise, the CSF exclusively grants the titles of Chartered Life Underwriter (C.L.U.) and Registered Life Underwriter (R.L.U.). A professional can only obtain these titles, which are guarantees of expertise and reputation, after completing a high-calibre learning program combining university courses and professional development.

Learning program

- The program leading to the title of registered life underwriter (R.L.U.) consists of eight university courses totalling 24 credits as well as the thirteen training activities in The Concepts in insurance of persons (program developed by the CSF, with some courses currently offered only in French).

- The program leading to the title of chartered life underwriter (C.L.U.) consists of sixteen university courses totalling 48 credits as well as the thirteen training activities in The Concepts in insurance of persons (program developed by the CSF, with some courses currently offered only in French).

What is the purpose of a professional title?

The university training leading to the titles of C.L.U. and R.L.U. promotes the development of knowledge about estate and tax planning as well as insurance and financial products for individuals and businesses, and provides more in-depth knowledge about disability and critical illnesses insurance, group insurance and investments.

The program Les concepts en assurance de personnes [concepts in insurance of persons] was designed to hone the knowledge of financial security advisors regarding the various products available on the market and to develop their ability to identify and analyze financial needs so they can make recommendations that best suit their clients’ requirements.

If you would like more information about obtaining these professional titles, click here.

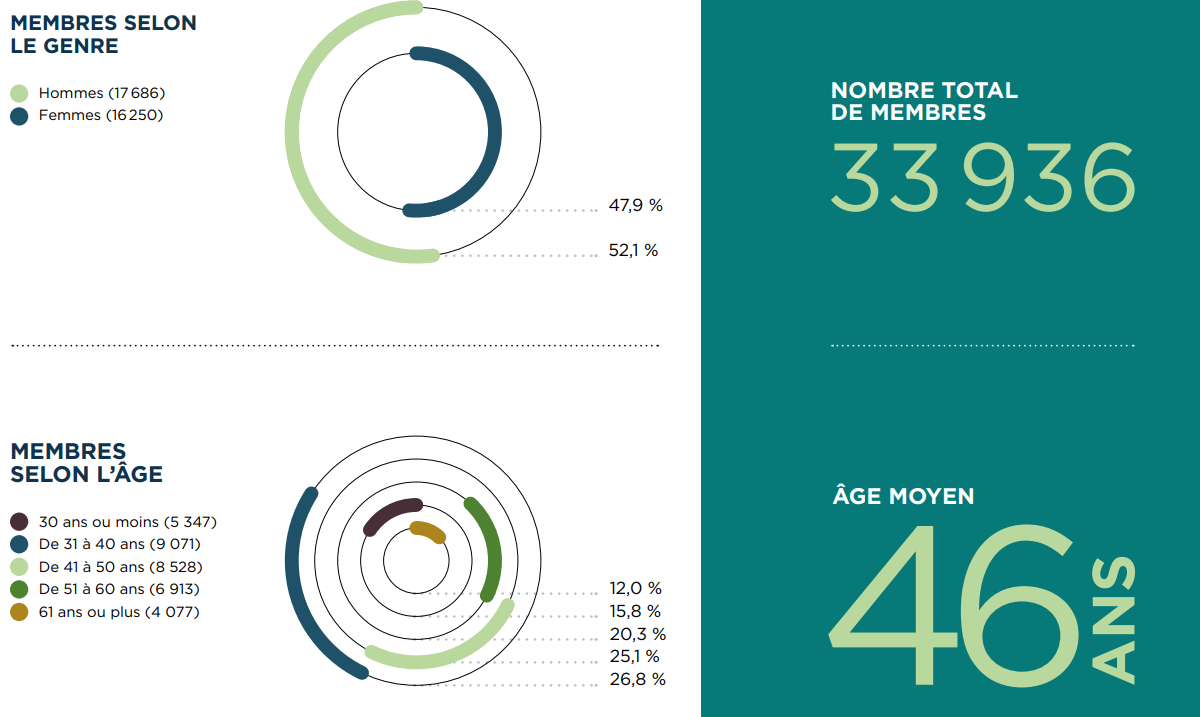

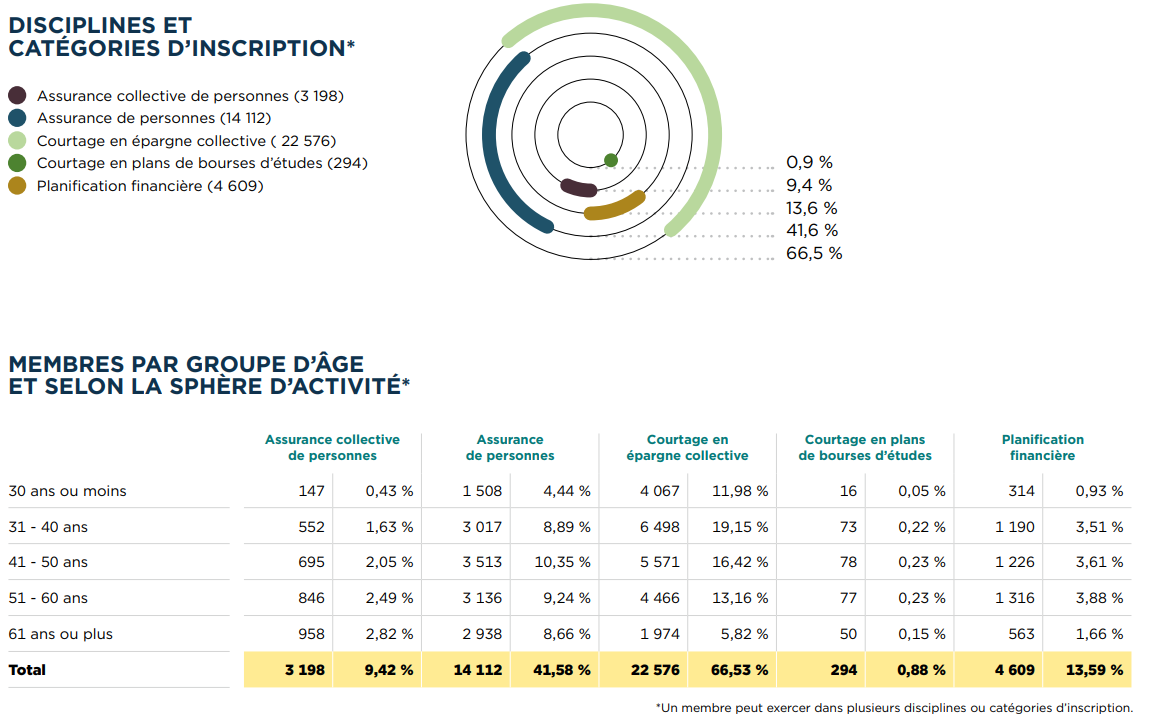

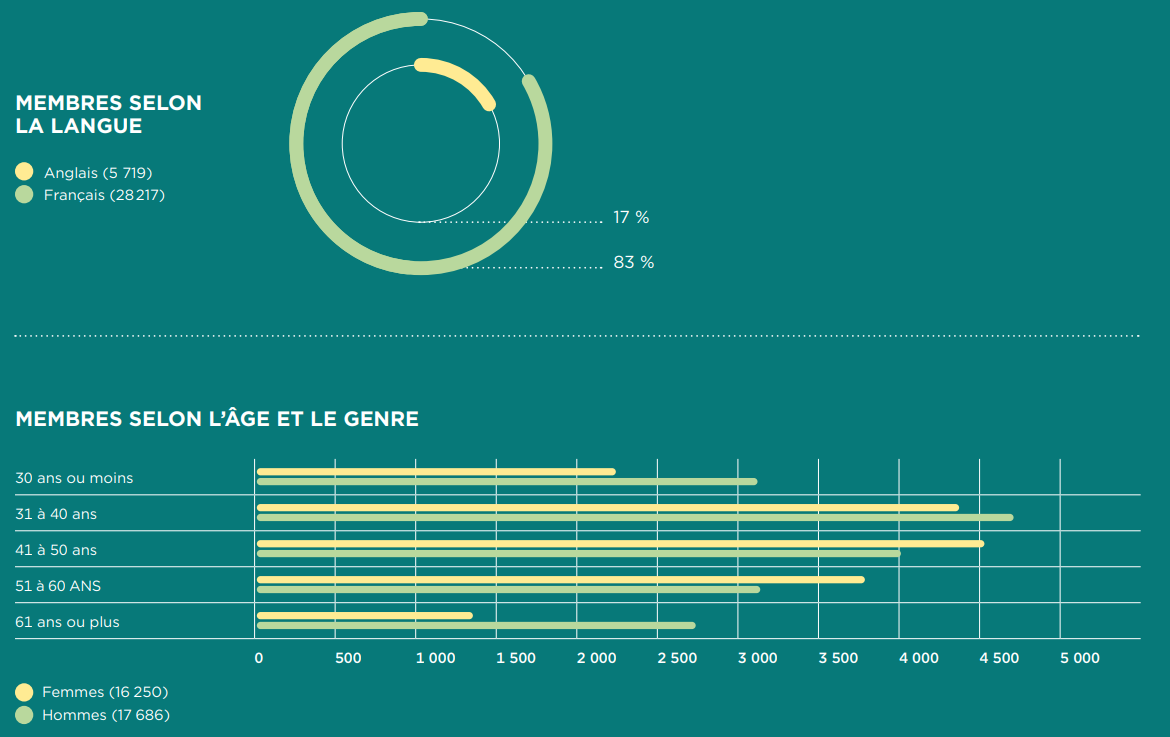

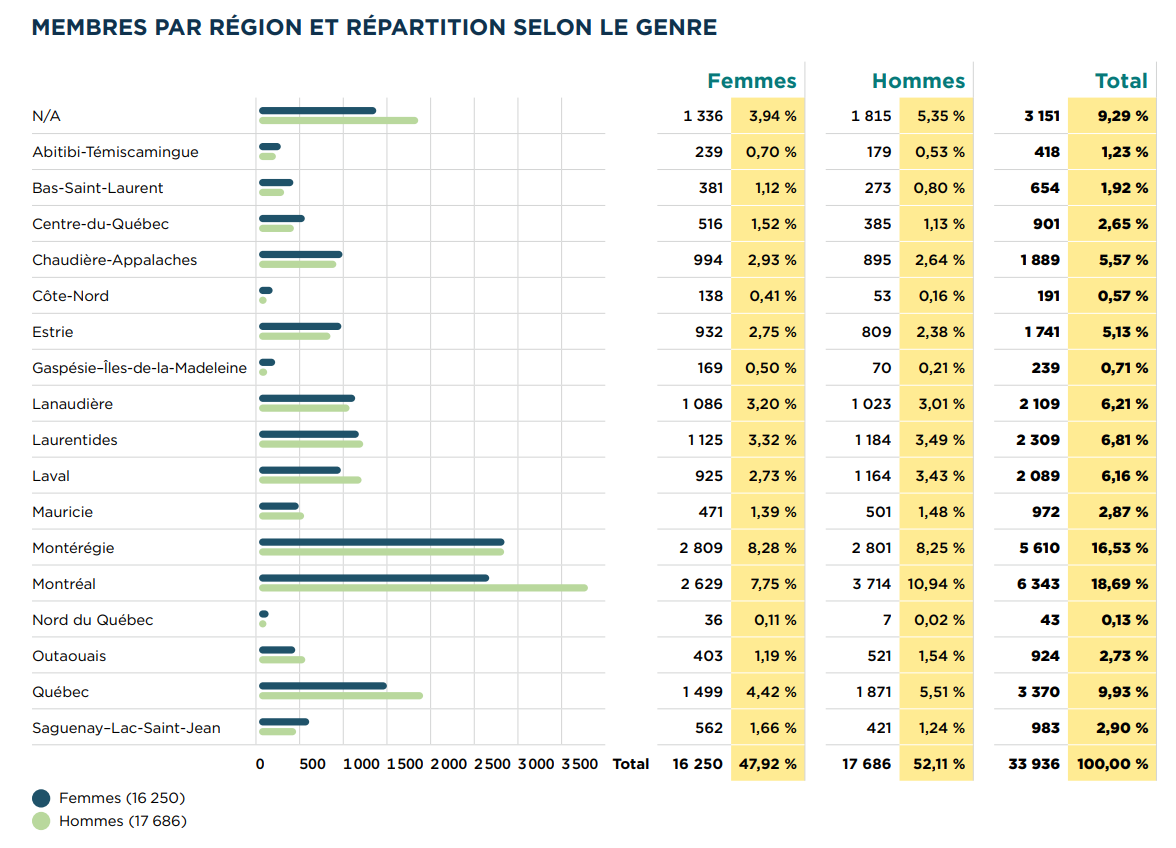

Profile of members of the CSF (as of December 31, 2024) (only available in French)

Read also

PRESS RELEASE