Should you restructure your debt to make your interest payments tax-deductible?

Given the times we’re living in, it’s not surprising that the Bank of Canada recently decided to keep its key interest rate steady at 0.25%. With interest rates at historic lows, it may be advantageous for some individuals to use borrowed capital instead of their savings, particularly if the latter have fallen in value.

The majority of advisors are familiar with the strategy of restructuring debt to make interest payments tax-deductible. The aim of this strategy is to increase after-tax returns. This leveraged approach has potential tax benefits, but it also involves significant risks and isn’t appropriate for everyone.

Both the AMF (Autorité des marchés financiers) and the CSF caution against using leveraged strategies, which are typically reserved for the most aggressive investor profiles. If a portfolio has a fixed-income component, the interest payments are likely to generate a succession of fixed annual losses. In this case, you’d be better off repaying the debt using the non-registered investments directly and then following an automatic savings approach. Such an approach is likely to be more advantageous than making interest payments tax-deductible.

For example, say an investor has a $100,000 portfolio that is equally balanced between fixed income (50%) and growth equity (50%) and a $100,000 loan over 20 years. Using the IQPF’s projected figures for 2020, we’d get a return (net of fees) of 3.25% and an interest rate of 4.40%. Note that we have not limited interest deductibility to Quebec only.

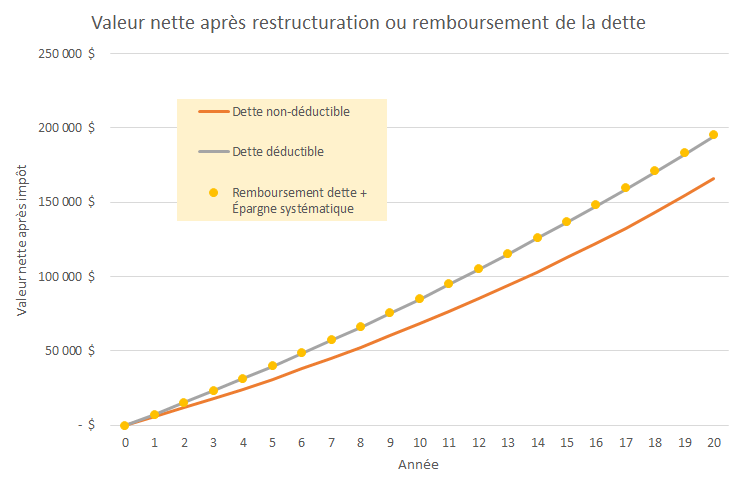

Assuming a 40% tax rate, the table below reveals that the after-tax value would be higher if the investor repaid the debt and used automatic savings than if they made the interest payments tax-deductible. By repaying the debt, the investor avoids generating a fixed annual loss.

After-tax value – Restructuring vs. repaying debt | |||

Year | Non-tax-deductible debt | Tax-deductible debt | Automatic savings |

0 | - $ | - $ | - $ |

1 | $5,781.14 | $7,541.14 | $7,621.14 |

5 | $31,059.13 | $39,713.93 | $40,107.33 |

10 | $68,158.18 | $84,858.93 | $85,618.05 |

15 | $112,556.63 | $136,186.08 | $137,260.14 |

20 | $165,790.73 | $194,552.29 | $195,859.64 |

Even if the interest rate were lower, returns on fixed-income securities tend to be lower than long-term interest rates. In addition, an automatic savings approach offers investors more flexibility in the event of budgetary pressure due to changes like a loss of employment or disability.

Unless all your investments are in growth stocks, repaying your debt and using systematic savings turns out to be a better strategy for the majority of people. This doesn’t imply that a portfolio composed entirely of growth stocks is a guarantee of success. If we consider the non-linear nature of returns—in other words, volatility (as demonstrated by the Monte Carlo simulation)—the likelihood of success goes down considerably due to poor market synchronization.

If a client doesn’t fully understand how leverage works and the risks involved, it may not be the right solution for them. The CSF requires representatives to provide clients with a document entitled Utilisation de l’effet de levier lors de l’achat de titres d’organismes de placement collectif (Using leverage when purchasing mutual fund securities) and go over the document together with them if borrowed capital is used to acquire mutual funds.

When it comes to using leverage, it pays to heed the advice in the saying “He who pays his debts gets richer.”

Read also

PRESS RELEASE

MAIN FEATURE

Taking up residence outside the country for varying periods of time is a project that attracts many people. In Canada, some 900,000 snowbirds spend several months in the southern United States every year. What's more, the choice of destinations and the reasons for doing so, whether personal or professional, have diversified. This dossier is packed with tips and best practices to guide advisors and their clients in their preparations. Financial challenges and tax obligations are among the topics covered.